SurePayroll Review: Is It Really Worth The Money?

We Really Liked:

- Easy operating system makes the SurePayroll software very easy to navigate.

- Reasonable price plans, appropriate for all types of business.

- It has basic HR services.

- Robust Payroll processing.

- There are employee benefits.

- Restaurants and household employers can also make use of the SurePayroll Software.

Best For:

- Calculating taxes and paychecks can be very stressful for sole proprietors of businesses, especially if the business is fairly new. Using SurePayroll omits any chances of mishaps from occurring and carries out the entire payroll process with utmost proficiency.

One Thing to Watch Out For:

- SurePayroll has only two third-party software integrations unlike other software in the market that have multiple third-party software integrated into them.

SurePayroll Overview

Keeping track of employee payments and taxes can be hard, especially when you are having to run a business. And why not, especially when so many things require your attention 24/7.

While running a growing business, a payroll software like SurePayroll can really help you ease off the stress by carrying out the tedious task of sorting out the payroll automatically every month. This also averts risks of calculation mistakes and makes the time-consuming process of payroll a lot faster.

Their pricing plans start from $19.99 a month which makes it affordable for small businesses and startups. The software also contains numerous features which can be added on later if you opted for the basic plan. A lot of these advanced payroll features come for free if you choose the Full Service plan which comes at $29.99 monthly.

SurePayroll Features

Having trouble dealing with payrolls? The SurePayroll software is here to save you!

The software is pretty straightforward to manoeuvre, which makes it very convenient for regular use. Easy operation makes the SurePayroll software perfect for small businesses that want to enhance the overall process of their payroll tasks with precision.

SurePayroll allows its users to choose whether they want to take care of the tax filing feature by themselves or not. Frankly, the software itself is very user-friendly and contains an in-detailed guide on how you can navigate through the software to receive the best outcome.

In case you still face trouble following the step-by-step guide, one of their representatives will be there to help you out to get a hang of the features.

So, if you are considering subscribing to SurePayroll’s services, here’s a list of some of the core features of the software, which are essential for any payroll related tasks:

Processing the Payroll

SurePayroll has multiple features on its software that can stand out to be extremely beneficial for any small to large business. Handling payroll manually can sometimes end up being a very messy and time-consuming process.

Not to mention, there are risks of inaccurate figures or calculations, which can sometimes turn out to be a fatal outcome for your business! So, if you want to eliminate any mishaps surrounding your company’s payroll services, SurePayroll’s software might be the only solution for you to get rid of your worries entirely.

SurePayroll opens doors to selecting multiple pay rates, unlimited pay runs, pay schedules and bonuses for its users. Employers can choose to pay their contractors or employees through a two-day direct deposit, or by way of paper checks.

What’s more, users can avail flexible payroll options which include same day or next day rushed payroll and automatic pay runs.

Another feature that the users absolutely love is the ‘Cancel Payroll’ option. This option enables you to cancel payroll before SurePayroll’s time period for cancellation ends. The feature comes in handy when you have accidentally made a mistake when completing the pay run.

Lastly, all of these functions are also available on SurePayroll’s app and is compatible with both iOS and Android mobile phones. This means that employers can take care of their payroll tasks in a matter of seconds by using the app on their phones.

Managing Taxes

Tired of dealing with tax payments? SurePayroll has got your back!

The software saves time that company administration would have otherwise spent wasting during office hours. Not to mention, there are always risks of making errors when doing time-consuming tasks manually.

The SurePayroll software takes it upon itself to take care of your tax filings, calculations and withholds. And it goes without saying that it gets the job done with precision and accuracy.

Perhaps the best thing about purchasing SurePayroll’s Full Service plan is that if there is an issue with the taxes at any point of time due to an error made by the representatives of the software, they will take full responsibility for it and pay for the damages.

Their services will also help you to file 1040-ES and Schedule-H for ‘Nanny Taxes,’ and also assist in filing year-end reports (940, 941, W-2, W-3, 1099 and 1096). Moreover, you will not have to worry about filing and paying federal and state unemployment insurances as SurePayroll will take care of it for you, that too right on time.

However, if you happen to live in Pennsylvania or Ohio, an additional cost of $9.99 has to be paid monthly while paying for your local taxes. Multi-state tax filing will also cost the same.

HR Tools

Even though the SurePayroll software is not as good as the HR software apps out there, it does however contain some of the basic functions to provide average HR services. Some of its basic HR functions include compliance posters, forms and providing an HR adviser.

An advantage of having purchased the Full Service plan is that you will be able to avail all of these HR features free of cost.

In case you have the Self Service plan, all you have to do to benefit from these HR services of SurePayroll is to pay an extra amount of $9.99 per month.

Apart from the benefits of its HR functions mentioned above, SurePayroll also helps to store your employee data which is necessary for making the pay runs. Not to mention, you will also be reported about the new hire state.

What’s more about SurePayroll’s HR functions is that it helps you run background checks of new recruits before hiring. SurePayroll will also be able to carry out tasks such as behavioural assessments, drug screenings and testing skills or talent.

Lastly, employees can also benefit from SurePayroll’s “personal development inventories” section where employers can create assessments for them. This will enable them to pinpoint the individual prospective growths of the employees.

Availing Employee Benefits

SurePayroll often offers employee benefits to its consumers which include health insurance, compensation insurance and 401k retirement plans. They do this by partnering up with certified insurance agencies like The Hartford, Liberty Mutual, Paychex Insurance Agency and Travelers.

Therefore, if you can’t afford an HR software for your employees, investing in SurePayroll can also help you to provide certain HR services like providing employee benefits.

Integration of Third-party Software

With two basic third-party software integrated into it, SurePayroll does not have any other third-party software. The two third-party software include Time Clocks which has plenty of features such as Buddy Punch, TimeTrex, SpringAhead, TimeForge, Homebase, Stratustime.

The other third party app is Accountings which also contains many features like Less Accounting, Sage 50, AccountEdge, Zoho Books, Kashoo, Xero and QuickBooks.

Comparing to Competitors

With robust payroll service outcomes, SurePayroll is surely one of the best payroll software available in the market right now. Due to its ease of use and reasonable pricing, small businesses generally prefer using SurePayroll.

Not to mention, its services are pretty great for large businesses too. Unlike other payroll software, SurePayroll can be used in restaurants, by house employees and also in professional business spaces.

However, while the customer service may take a while to respond to your pressing queries, they do eventually get back to you and see you through the solution till the problem is fixed, according to user testimonials.

Top 3 Payroll Services

- 1 month free trial

- Trusted by over 200,000 businesses

- All-in-one payroll and HR solution

- Best for small businesses

- “Autopilot” runs payroll itself

- 6 months free with signup

- Trusted by 850,000+ businesses

- Dedicated customer service

- Also offer HR and benefits management

- 3 months FREE with signup

- Trusted by 700,000 companies

- Over 45 years of experience

- All-in-one platform

Pricing

SurePayroll’s Self-Service plan is not inclusive of tax filings and can cost $19.99 on a monthly basis with an additional $4 per employee. This means that if you opt for its Self-Service plan, you will have to handle your taxes on your own.

However, in case you want the Full Service plan, your tax filings will be handled by SurePayroll. The Full Service Plan starts at $29.99 per month with an additional fee of $5 per employee. Once you have bought a plan for yourself, you can then add on to the service by customizing your plan with innovative payroll tools like ‘Time Clock Software Integrations’ and ‘Accounting.’

Paid add-ons on the SurePayroll software offers accounting integration for $4.99, Time clock integration for $9.99, Multiple state filing for $ 9.99, stratustime integrated time clock for $5 with an additional $3 per employee and Ohio or Pennsylvania local tax filings for $9.99 on a monthly basis.

Moreover, you will have an added expense of $7.99, if you want to upgrade your usual payroll service to a two-day payroll processing service. For $9.99 monthly, users can have access to compliance posters, HR forms and an HR adviser from SurePayroll’s payroll package.

Both the Self-Service plan and the Full Service plan come with added benefits such as direct deposits, new hire state reporting, unlimited pay runs, online pay stubs and automatic payrolls.

The processing timeline for the Self-Service plan can take up to 4 days. This plan comes with core payroll features such as multiple pay rates and bonuses, unlimited pay runs, direct deposits, online pay stubs and new hire reporting.

On the other hand, the Full Service plan requires a mere time period of 2 days to get done with all the processing. Apart from the basic payroll features mentioned above, this plan comprises of additional features on the software like access to an HR Adviser, HR Forms and Compliance Posters, Year-end Reporting (W-2/1099 Forms) and Payroll Tax Filing Service.

Free Plan

Unfortunately, SurePayroll does not offer any free plans for its users.

Ease of Use

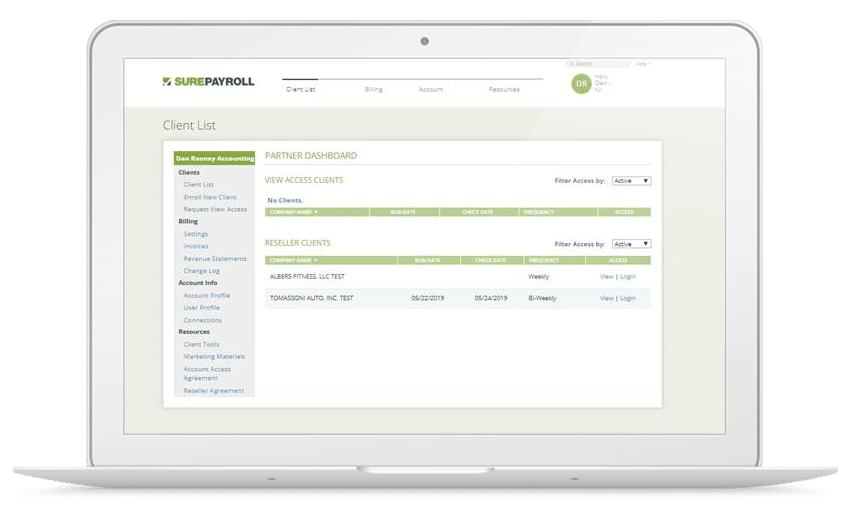

The SurePayroll software has a great user interface and an innate dashboard. As long as you have the employee and business directory with you, setting up the software is fairly easy.

The interface is not cluttered which makes navigating through the software effortless. Not to mention, the less messy the dashboard, the less stress you will have while giving out important software commands like pay runs for your employees.

Nonetheless, here is a step-by-step guide on how you can set up the SurePayroll software on your own:

- You will require an Employer Identification Number EIN and State Tax ID.

- Next up, you will have to ask your employees to fill up the W-4 form.

- Schedule your payroll and set the payroll frequency once the W-4 forms are complete.

- It is essential that you highlight the due dates.

- Up next, you have to fill out information for tax filing.

- Withhold and calculate taxes by putting in the accurate amounts.

- Pay Taxes.

If you require any further assistance regarding the set-up, you can get in touch with SurePayroll’s representatives from their customer service to help you out. However, its website also has several basic questions answered regarding the set-up on their Frequently Asked Questions Page.

SurePayroll on Mobile

Perhaps the only issue with processing payroll using your computer is that it is not portable. And it is not always possible to be able to work from an office space. This is exactly why SurePayroll has its own app which is able to carry out all the software functions, including paying all your employees through the ease of your mobile phone.

Both iOS and Android phones are compatible with the SurePayroll app. Using this app, employers can also have immediate access to their employee information, bank holidays, payroll deadlines, hours worked, etc.

The Bottom Line

All in all, SurePayroll is one of the best payroll software that is mostly suitable for small businesses. Although businesses with 1000+ employees can also use this software, SurePayroll itself was designed to be used for less complicated functions as well.

So, what are you waiting for? Get the SurePayroll today and run an effective business operation from the get-go!